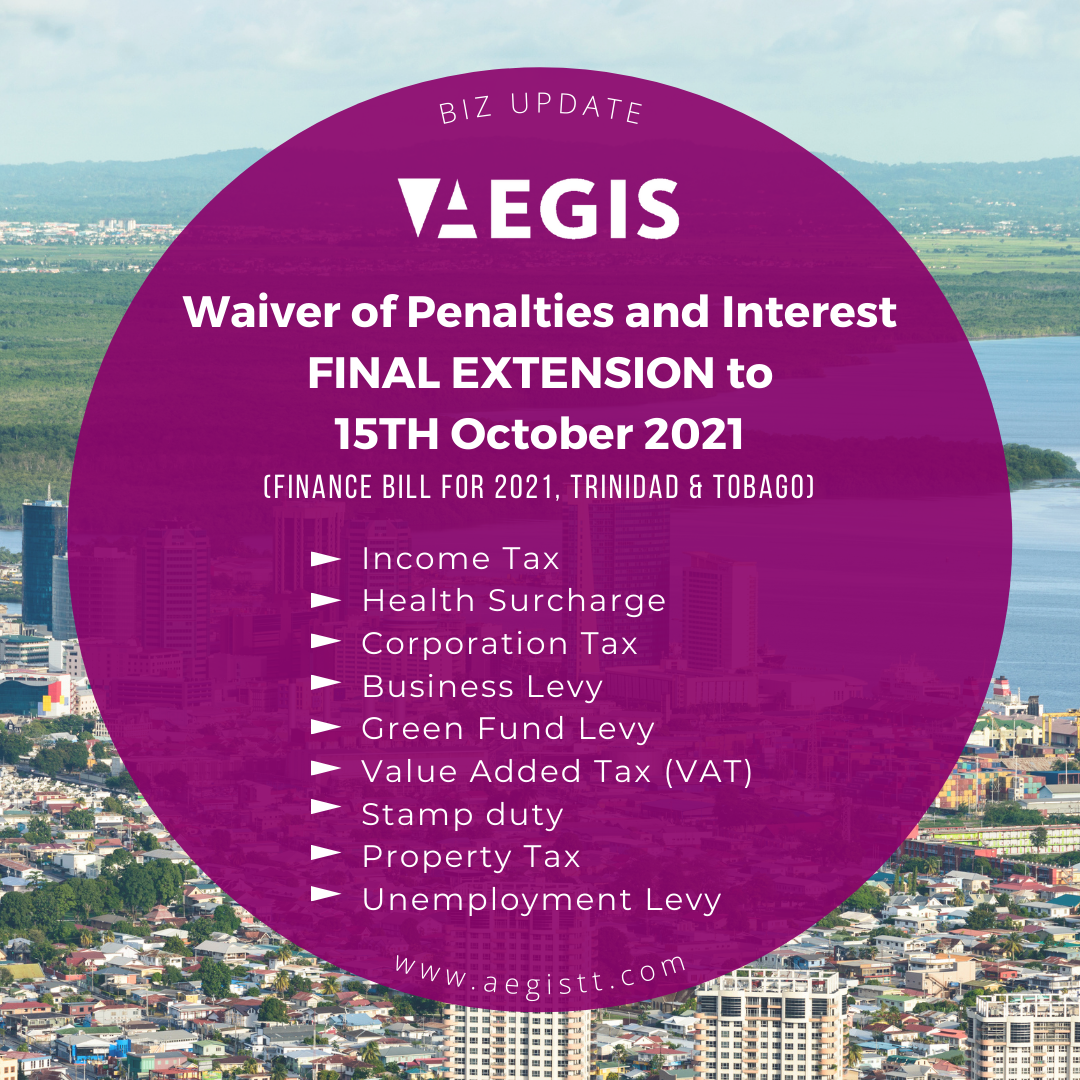

The Minister of Finance, Trinidad and Tobago has sent out legal notices in which it states that the tax amnesty has been extended for the final time, from 17th September 2021 to 15th October 2021. It should be noted that there will be no further extension of the 2021 Amnesty after October 15th, 2021.

The Finance Bill for 2021 has introduced several waivers regarding the following liabilities stated below:

(a) Interest on an outstanding tax due and payable for the years up to 31st December, 2020 and during the period 1st January, 2021 to 31st May, 2021, where the tax is paid prior to or during the prescribed period

(b) Outstanding interest charged on an outstanding tax due and payable for the years up to 31st December, 2020 and during the period 1st January, 2021 to 31st May, 2021, where the tax is paid prior to or during the prescribed period.

(c) A penalty due and payable on or in respect of a tax or outstanding tax or interest for the years up to 31st December, 2020 and during the period 1st January, 2021 to 31st May, 2021, where the tax is paid prior to or during the prescribed period.

(d) A penalty on an outstanding return for the years up to 31st December, 2020 and during the period 1st January, 2021 to 31st May, 2021, where the return is filed prior to or during the prescribed period.

(e) A penalty with respect to a return for the years up to 31st December, 2020 and during the period 1st January, 2021 to 31st May, 2021, filed prior to 5th July, 2021, where the penalty has not been paid.

The following taxes are included in the above:

- Income Tax

- Health Surcharge

- Corporation Tax

- Business Levy

- Green Fund Levy

- Value Added Tax (VAT)

- Stamp duty

- Property Tax

- Unemployment Levy

For the purposes of this section, “prescribed period” means the period commencing on 5th July, 2021 and ending on 17th September, 2021. However, the Minister of Finance may prescribe a later date as he sees fit. Where a tax remains outstanding after the end of the prescribed period – the interest and penalty which would have been payable on the outstanding tax, shall be revived and become payable as if the waiver had not been granted.

If you have any questions for your business in any area or department function, please contact us at info@aegistt.com or call us at +1 868 625 6473