THE USE OF TECHNOLOGY

With the threat of the global COVID-19 pandemic still being ever so present in our society and the national guidelines issued to safeguard our health and safety as a nation, we should continue to look towards technology and innovation as solutions to the negative effects of the restrictive measures implemented.

DID YOU KNOW THAT?

The Board of Inland Revenue (BIR) is continuing their drive for online filing of taxes and has a non-logged in service available to all taxpayers.

Be in the know, and have all you need ready and accessible.

e-TAX

e-Tax is the online portal provided by the Inland Revenue Division (IRD) for taxpayers to manage their tax accounts online. By accessing e-Tax, taxpayers can register to view their accounts, file returns, and correspond with IRD.

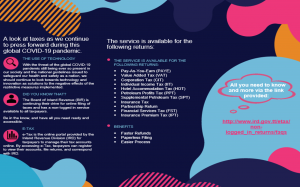

THE SERVICE IS AVAILABLE FOR THE FOLLOWING RETURNS:

- Pay-As-You-Earn (PAYE)

- Value Added Tax (VAT)

- Corporation Tax (CIT)

- Individual Income Tax (IIT)

- Hotel Accommodation Tax (HOT)

- Petroleum Profits Tax (PPT)

- Supplemental Petroleum Tax (SPT)

- Insurance Tax

- Partnership Return

- Financial Services Tax (FST)

- Insurance Premuim Tax (IPT)

BENEFITS

- Faster Refunds

- Paperless Filing

- Easier Process

Technology and innovation once again providing solutions for the business community in what we know as the new normal.

Here’s a look into what’s trending as it relates to taxation during the COVID-19 pandemic.

All you need to know and more via the link provided: