Aegis Associate Audit team member Carolyn Felmin explains an overview of audit opinions and what they mean for your business

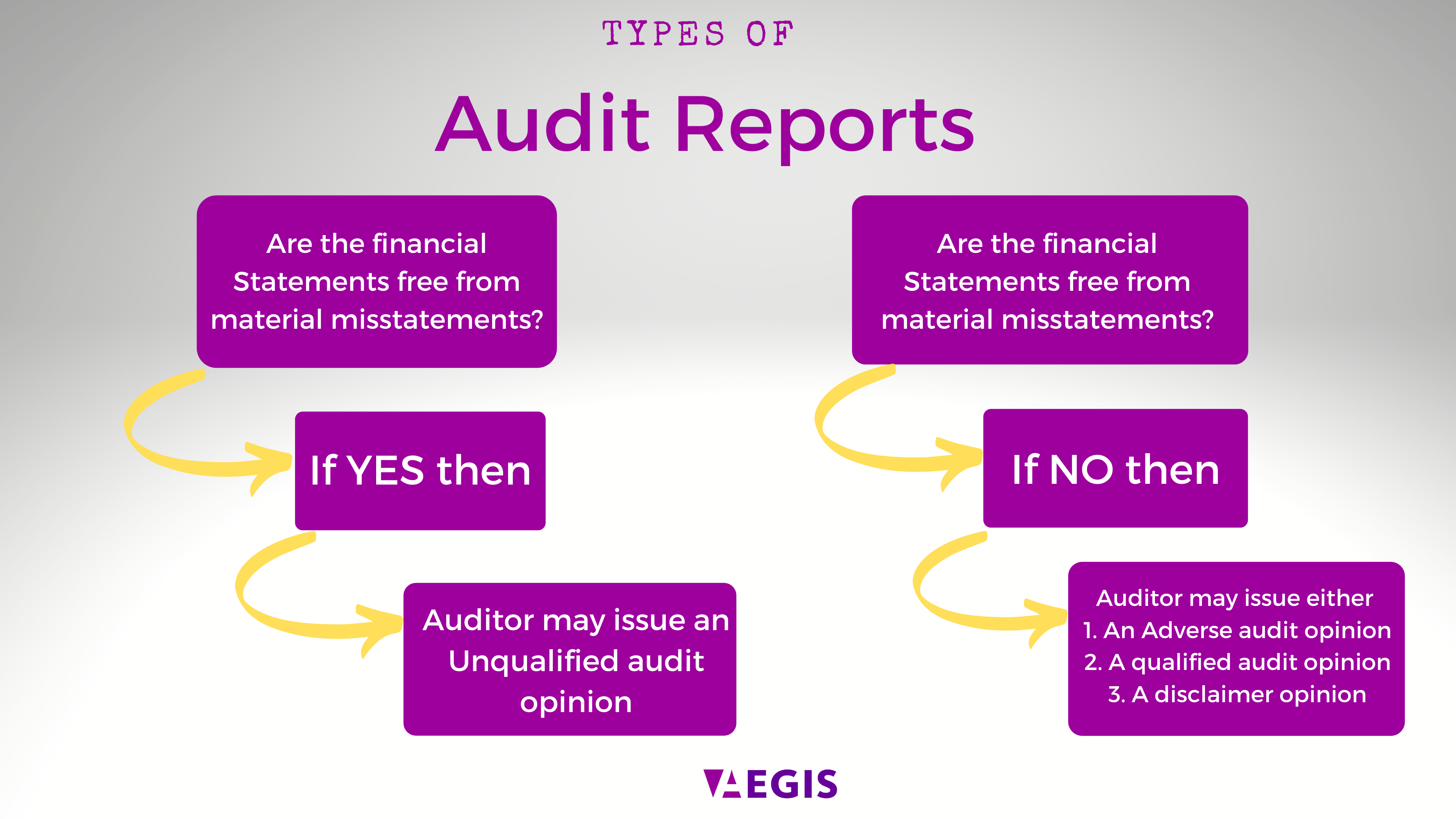

Auditors form an opinion as to whether the financial statements are presented fairly, in all material respects, and in accordance with the applicable financial reporting framework.

In forming that opinion, the auditor shall conclude as to whether they have obtained reasonable assurance as to whether the financial statements as a whole are free from material misstatement, whether due to fraud or error. “A material misstatement is information in the financial statements that is sufficiently incorrect that it may impact the economic decisions of someone relying on those statements.” (Source: Accounting tools)

Where an auditor is able to conclude that the financial statements are prepared in all material respects, and in accordance with the applicable financial reporting framework, the auditor shall express an unmodified audit opinion. Unmodified meaning, the auditor was satisfied with the financial statements audited.

In an instance where the auditor is able to conclude that based on the audit evidence that the financial statements as a whole are not free from material misstatement, or they are unable to obtain sufficient, appropriate audit evidence, they can issue a modified opinion in the audit report.

There are 3 types of modified audit opinions:

- Qualified opinion

- Adverse opinion

- Disclaimer of opinion

A Qualified Opinion is issued when the auditor has obtained sufficient, appropriate audit evidence but concludes that misstatements, individually or in the aggregate, are material, but not pervasive, to the financial statements; or is unable to obtain sufficient, appropriate audit evidence on which to base the audit opinion.

An Adverse Opinion is issued when the auditor has obtained sufficient, appropriate audit evidence but concludes that misstatements, individually or in the aggregate, are both material and pervasive to the financial statements.

A Disclaimer of Opinion is issued when the auditor is unable to obtain sufficient appropriate evidence on which to base the opinion and the auditor concludes that the possible effects of the undetected misstatements could be both material and pervasive.

The auditor will also issue a disclaimer of opinion when, having obtained sufficient appropriate audit evidence, it is not possible to form an opinion on the financial statements due to the potential interaction of multiple uncertainties and their possible cumulative effect on the financial statements.

An Emphasis of Matter Paragraph is a paragraph included in the auditor’s report that refers to a matter appropriately presented or disclosed in the financial statements that, in the auditor’s judgment, is of great importance that it is fundamental to users’ understanding of the financial statements.

|

Nature of Matter Giving Rise to the Modification |

Auditor’s Judgment about the Pervasiveness of the Effects or Possible Effects on the Financial Statements |

|

| Material but Not Pervasive | Material and Pervasive | |

| Financial statements are materially misstated |

Qualified opinion |

Adverse opinion |

| Inability to obtain sufficient appropriate audit evidence |

Qualified opinion |

Disclaimer of opinion |

Source: ISA 705 (Revised) Modifications to the Opinion in the Independent Auditor’s Report

For more information on our audit and assurance services, please contact Vernetta at info@aegistt.com